In order to set up a fintech business in Estonia, both local and foreign investors need to obtain crypto licenses. A change in the legislation transformed the two available types of licenses into a single one, called the Virtual Currency Service Provider license.

Our company formation consultants in Estonia can help foreign investors who want to set up cryptocurrency and blockchain businesses in this country. We can also provide complete assistance to those who wish to obtain an Estonia crypto license.

| Quick Facts | |

|---|---|

| Special legislation available (YES/NO) |

NO |

|

Regulatory authority |

Financial Supervisory Authority |

|

Types of entites used to register the company |

The private limited liability company (OU) can be used to open a cryptocurrency company in Estonia |

| Local manager required (YES/NO) |

YES, however, these can also be e-residents in Estonia |

| Minimum capital requisites (YES/NO) | EUR 25,000 is required for an OU, however, for certain companies EUR 12,000 will suffice |

| License required (YES/NO) |

YES, in Estonia, a crypto license must be obtained |

| Licensing exceptions (YES/NO) |

YES, for companies not engaged in crypto trading activities |

| Timeframe to register the company (approx.) | Approx. one week |

| Anti-money regulations applicable (YES/NO) | YES, Anti-Money Laundering Regulations contain specific conditions for crypto license holders in Estonia |

| Specific requirements for foreign investors (YES/NO) | No, foreign investors do not need to meet specific requirements to obtain Estonian crypto licenses |

|

Activities permitted for crypto companies |

Trading, ATM set up, e-wallet services, mining, virtual money services support |

| Other special requirements applicable (YES/NO) | No, apart from obtaining an Estonian crypto license |

|

Taxation of crypto companies in Estonia |

Corporate tax applies if the profits of the company are distributed |

| Why choose Estonia |

– 0% corporate tax if the profits are not distributed – Estonia is the most advanced country in terms of e-services |

| Support in launching cryptocurrency business (YES/NO) | YES, we can help with the creation of a cryptocurrency company and obtaining the crypto license in Estonia |

| Income tax rate | 20% |

| Double tax treaty network | YES, Estonia has approximately 60 double tax treaties |

| Support in company registration (YES/NO) | YES, we offer company registration services in Estonia |

What to consider when opening a crypto business in Estonia in 2024

Setting up a business in the fintech sector in Estonia usually implies operating in the cryptocurrency field, considering the legislators have went through significant efforts to create and improve the laws governing this industry.

Most cryptocurrency companies rely on innovation when announcing their services which is why they rely on crowdfunding platforms to raise money for their operations. For this purpose, before launching the owners will usually have to:

- have a good business plan in place in order to attract investor,

- follow a business model which guarantees the success of the company up to a certain point.

These are essential when seeking to operate in fields that have not been explored before. However, Estonia is not the regular country to open a crypto company in, as the country started the road to digitalization of its services more than 10 years ago, thus becoming a pioneer among European countries in relying on technology for most the services provided by the public administration to Estonian citizens and companies.

This is why obtaining a crypto license in Estonia in 2024 is no longer such a big challenge when seeking to start such a business.

If you need information on the requirements related to starting a crypto business, our specialists in company registration are at your service for guidance. Our Estonian company formation consultants can offer thorough information on the criteria which are imposed to set up company in Estonia and the costs which are involved with such a start-up.

The registration process for a bitcoin company in Estonia

To register a bitcoin business in Estonia, first, a company name has to be chosen and then it has to be verified for availability.

Then, the company must be registered at the Commercial Register. Next, it has to be registered as a VAT payer and it must register any employees in the employee registry.

If you would like to open an Estonian cryptocurrency company, we can advise you on all the necessary procedure required to make this process as simple and fast as possible. We can also advise on how to apply for the Estonia cryptocurrency exchange license.

Licensing requirements for cryptocurrency companies in Estonia

The Virtual Currency Service Provider license which can be obtained by Estonian companies is issued to:

- cryptocurrency exchange service providers;

- cryptocurrency wallet service providers.

The Estonia cryptocurrency exchange license will enable the Estonian company to provide exchange services to those interested in trading cryptocurrencies against money or against other cryptocurrencies. The second type of license is issued for companies offer virtual token wallets or e-wallets.

A cryptocurrency wallet can be used for sending and receiving cryptocurrencies through online and offline digital channels which rely on public-key cryptography. There are two types of services that can be provided under this license:

- the first one is the offline or cold wallet which implies using hardware to complete transactions,

- the online or hot wallet which implies offering storage services.

Out of these, hot wallets can be used to safe-keeping small amounts of conventional money, thus enabling the user to save money on a daily basis, should one want to.

The good news about this type of crypto license in Estonia is that under one license both types of services can be offered in 2024.

There are also other types of businesses that can be established in Estonia. These do not require any special license as they will not be involved in trading activities. Among these, the most common ones are IT companies involved in digital token mining activities. Also, cryptocurrency companies can also handle the installation of virtual money ATM machines.

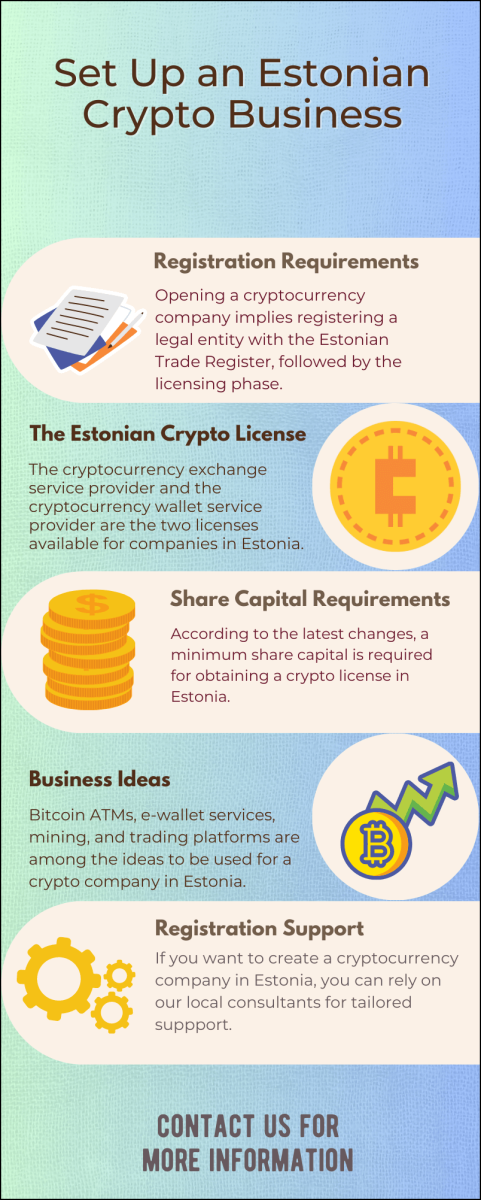

Our local specialists in company registration in Estonia can advise on the registration of any type of cryptocurrency business. We also invite you to read our infographic on this subject:

How to obtain a crypto license in Estonia

The applications for one of the two cryptocurrency licenses mentioned above must be filed with the Financial Supervisory Authority through the Financial Intelligence Unit. The documents that need to be submitted are not many, among them the most important ones being the company’s Certificate of Incorporation and the Know Your Client and the risk assessment documentation.

The granting of the Estonia crypto license is subject to regulation changes as the Estonian government is set to impose more complex regulations under a new bill for issuing virtual currency activity licenses to companies engaged in the sale and/or purchase of virtual currencies as well as companies that provide virtual wallet services.

Some of the most important regulations for those who apply for a virtual currency activity license include the following:

- Investor suitability: the Financial Intelligence Unit will conduct a comprehensive background check on the company owners;

- Registered address: an important requirement is that the registered address of the company and the activities are to be located in the country; the board must also be based in Estonia;

- The state fee: for the Estonia crypto license is set to increase, from 345 EUR to 3,300 EUR; our team can provide complete details on the fees in force;

- The issue date: the entire licensing process will become lengthier as a result of the overall more complex verification procedures.

Due to new legislation, all relevant documentation for Estonian crypto licenses must now be submitted either to a notary’s office or through the Commercial Register. The review procedure has also been prolonged now taking 120 days. This occurs because companies with such activities are now considered financial businesses.

It is also worth noting that the state fee for a crypto license has increased to €10,000 up from €3,300 prior to the regulations change.

Another change is that all company members must have a good reputation, with no criminal record or involvement in fraudulent activity. In addition, all participants must present non-conviction certificates.

Crypto services are now subject to regulation under Estonian anti-money laundering legislation, which previously applied to financial institutions.

Companies in Estonia that already hold a license for cryptocurrency-related activities are required to comply with the regulations that will become mandatory for this purpose and are asked to submit additional information to the Financial Intelligence Unit, as needed. Some of the issues that will need attention, in the case of those that already have a license, can be those related to the suitability and the reputation of the company owners. Our team can provide more details and can help companies that are already have an Estonia cryptocurrency exchange license or another type of license comply with the ongoing requirements.

Until the license is granted, the Estonian company is not allowed to start its activities. However, the Estonia cryptocurrency exchange license is not difficult to obtain.

Document requirements for obtaining a crypto license in Estonia

A business entity must submit its application electronically to the Trade Register. It must contain the following:

- the physical office address in Estonia along with the necessary papers proving ownership/lease of the property.

- contact and personal information for the person in charge of communication;

- guidelines for internal procedures and quality assurance measures.

- the criminal record(s) of the firm owner or beneficiary shareholders, as well as their roles and responsibilities.

- corporate bank accounts, including those registered with the Estonian banking system.

- detailed information on the crypto assets will be provided by the company.

- proof of funds in euro, including a bank statement confirming sufficient amounts.

- business plan over the next two years.

New regulations applicable to Estonian cryptocurrency licenses

At the middle of 2020, the Estonian central authorities amended the regulations related to the issuance of the Estonia cryptocurrency license by inserting new anti-money laundering provisions. This way, both the activities of companies and their clients will be better protected.

Among the latest amendments, we can mention the following:

- a minimum share capital of 12,000 euros for a cryptocurrency company,

- the capital must be paid in full by the time the license is issued,

- the company must also have an IBAN account before filing an application for a license,

- the company must have a board or directors and a registered address in Estonia,

- the business must have at least one Estonian citizen as a director,

- the state fee for obtaining the license has also been increase to 3,300 euros.

If you have any questions on the new regulations related to applying for a crypto license in Estonia, do not hesitate to send them to our specialists.

Another change in the rules related to applying for a crypto license is that both types of permits will be available under the application for a Virtual Currency Service Provider License. The procedure has been simplified and the documents can be submitted online directly with the Ministry of Economic Affairs and Communications.

Our specialists can verify if you meet all the new requirements associated with obtaining an Estonia cryptocurrency license.

When obtaining an Estonia crypto license, companies that wish to engage in activities related to virtual currencies can reach out to our specialists who can provide updated information on the laws in force and how the Estonian authorities plan to regulate these activities. We also invite you to watch a video on this subject:

Why start a cryptocurrency company in Estonia?

At the level of 2023, 201 startups, or 13% of all businesses in the previous Estonian Startup Database, had a total revenue of 138,1 million euros (30% of the startup sector), which is attributed to the FinTech industry. By the end of the third quarter, FinTech companies had paid 48.84 million in employment taxes over the previous 9 months, employing 2903 individuals.

In case you need to know more about the bitcoin industry in Estonia or to set up a legal entity in this country, please speak to our friendly company formation representatives in Estonia. You can rely on our company registration representatives for full information and assistance related to the preparation of the documents needed to create a company and obtain the Estonia cryptocurrency license.