An Eesti filial (Estonian branch) is not considered a legal entity and its foreign parent company carries all the liabilities for its actions. The nature of the business performed by the branch dictates if it requires a special license or not. Certain companies must notify the Estonian Financial Supervision Authority before opening a branch, such as the investment companies, banks or insurance companies in order to receive licenses.

Our company formation specialists in Estonia can help you set up a branch office for your foreign company.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Foreign country |

|

Best Used For |

Highly regulated activities, such as financial ones |

|

Minimum share capital (YES/NO) |

no |

| Time frame for the incorporation (approx.) |

Approx. one week

|

| Documents to be filed by parent company | Parent company's Registration Certificate and statutory documents, branch registration application form, proof of legal address in Estonia, resolution for opening the branch office, bank statement confirming the share capital of the branch. |

| Management (Local/Foreign) |

Local |

| Legal representative required (YES/NO) |

yes |

| Local bank account (YES/NO) | yes |

| Independence from the parent company | Fully dependent on the parent company |

| Liability of the parent company | Liable for all branch office's obligation |

| Corporate tax rate | 20% |

| Annual accounts filing requirements | Audited annual income reports must be filed |

| Possibility of hiring local staff (YES/NO) | yes |

| Travel requirements for incorporating branch/subsidiary (YES/NO) | no |

| Double tax treaty access (YES/NO) | Yes, approx. 60 double tax treaties are enforced |

| Special requirements related to the trading name (YES/NO) | Yes, the branch must have the same name as the foreign company. |

|

Activities permitted |

It can undertake various types of activities. |

|

Restrictions (if any) |

It cannot engage in other operations than the parent company's. |

| Special licensing requirements (if any) | Yes, depending on the commercial activities undertaken. |

| Local address required (YES/NO) |

Yes, this is a mandatory requirement to set up a branch in Estonia. |

| Authority to be registered with |

Estonian Companies Register |

| Employment registration requirement (YES/NO) |

Yes, if the branch has employees. |

| Option to transfer employees from the headquarters (YES/NO) |

Yes |

| VAT registration requirement (YES/NO) |

Yes, when reaching an annual turnover of EUR 40,000. |

| Audit requirements (if any) | No, the branch is not subject to audit. |

| Online registration availability (YES/NO) |

Yes, including through professional company registration services. |

| Applicability of the corporate tax |

The corporate tax applies to the income generated in Estonia. |

| Access to tax benefits (YES/NO) |

Only to double tax treaties |

| Advantages |

– easy to register, – low maintenance costs, – access to the EU market. |

| Incorporation services availability (YES/NO) | Yes, we offer support in setting up an Estonian branch office. |

The main regulation that has to be respected by branches before performing any commercial activity it is that it has to be registered in the Estonian Commercial Register.

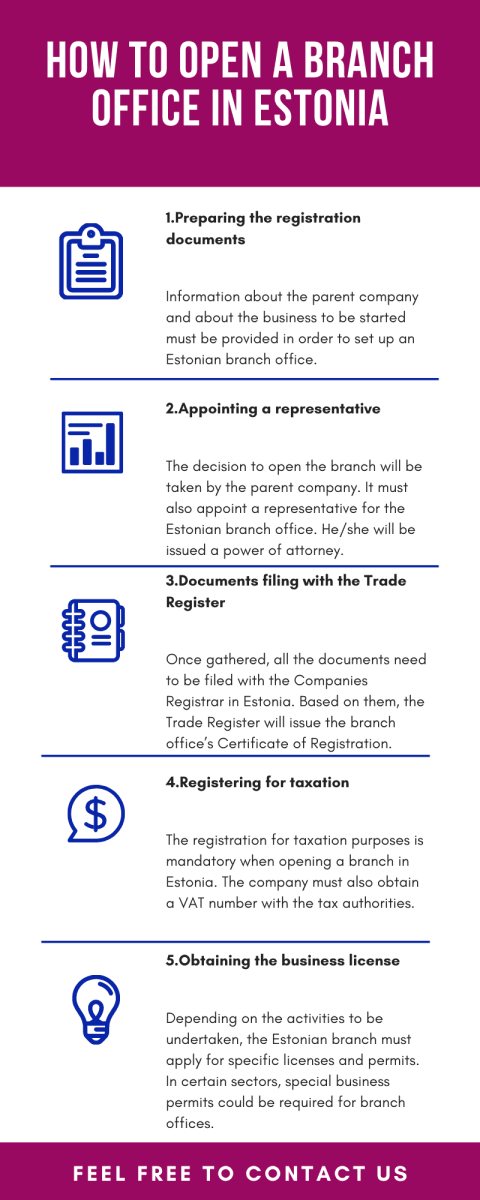

Below, you can read about the procedure of registering a branch office in Estonia.

Who can set up a branch office in Estonia?

The branch office is a business employed exclusively by companies, local or foreign, which will become corporate shareholders in the branch. In other words, the branch office cannot be established by a natural person, considering it is deemed as a satellite of another company. The Estonian legislation provides for the same requirements as other European countries in which this business form is available, therefore foreign companies with branches in other countries are accustomed to the procedure of opening a branch in Estonia.

If you want to open a company in Estonia and don’t know if the branch office is the right option for expansion, our local advisors can help you decide.

Characteristics of Estonian branch offices

According to the Company Law in Estonia, the branch office is regarded as an extension of the parent company which can be a local or a foreign entity. Estonian branch offices have the following features:

- they are permanent business forms which can be used for completing various activities in Estonia;

- they have the same responsibilities as their parent companies in terms of taxation in Estonia;

- the parent companies are also required to file specific financial documents with the tax authorities in Estonia;

- the parent companies must appoint representatives when opening branch offices in Estonia;

- from a taxation point of view, branches are taxed as local companies only on the incomes generated in Estonia.

It is important to note that most of the times, foreign banks and institutions in the financial sector operate through branch offices in Estonia. However, there are no restrictions related to setting up branches in other important investment sectors in Estonia.

Our company registration agents in Estonia can offer more information on the characteristics of a branch office.

The decision of starting an Estonian branch office

The registration of a branch in Estonia is based on a decision of the shareholders of the parent company, be it another Estonian company or a foreign one. The decision must be drafted under the form of a resolution which must contain information about the activities to be undertaken by the branch in Estonia and about the appointment of a representative who will sign on behalf of the parent company.

The resolution can be drafted in the language used in the foreign company’s home country, however, it will need to be translated into Estonian and authenticated before being filed with the Companies Register.

Another important aspect which needs to be considered when establishing a branch in Estonia is the trade name requirements. The Estonian legislation requires a company which opens a branch office to use its own name for the satellite company. While in the case of a local company, the search with the Trade Register is not required, the representatives of foreign companies are advised to verify the availability of the desired name.

Documents required to set up a branch in Estonia in 2024

The necessary documents for performing this are an application (containing the name of the parent company, the type of company, the objectives, the name and address of the managers, the name of the branch and its address, the name of the representative and the decision of opening a branch and appointing a manager), the memorandum of association, the articles of association, the certificate of registration.

It is important to know that the parent company will be in charge with preparing the documents to be filed with the Companies House in Estonia upon the incorporation of a branch office.

Apart from the documents mentioned above, the following papers must also be filed:

- – the certificate of registration of the parent company issued by the Trade Register in its home country;

- – the Memorandum and Articles of Association of the parent company (translated into Estonian);

- – the resolution passed by the shareholders of the parent company in which the decision of setting up the branch was taken;

- – a bank certificate which proves the share capital allocated to the operations of the branch office.

With respect to the resolution passed by the parent company, it is important to know that it must contain the following information:

- – the share capital allotted for opening the Estonian branch office;

- – the objective or object of activity of the branch office;

- – the appointment of a representative for the branch;

- – the representative’s acknowledgement to act on behalf of the parent company.

If you want to open a company in Estonia and are considering operating it as a branch office, our local consultants can help you prepare all the necessary documents in order to register it with the Companies Registrar.

The branch of a cryptocurrency company will need to obtain the Estonia cryptocurrency license before commencing its activities. Our team can provide more details. Our company formation agents can provide more details on the rules you must follow after acquiring a crypto license in Estonia. We can also help people who do not need a license but still wish to work in this field. We can offer representation in various matters, including with the authorities you need to complete various formalities with.

You can also see our scheme on how to create a branch in Estonia:

Share capital requirements for branch offices in Estonia

One of the most important advantages of a branch office is that the parent company is not imposed to allocate a specific amount of money as a share capital. As a matter of fact, the foreign company’s shareholders will decide the money required to set up and run their operations through a branch office.

The only exception is related to the opening of an Estonian branch in the banking sector which needs to meet the capitalization requirements imposed by the national laws in this country.

If you want to open an Estonian company, our agents can assist you in filing the documents with the Trade Register.

Registration procedure for a branch in Estonia in 2024

The registration of a branch in Estonia can be performed in person or online, on the Commercial Register portal.

After submitting the above documents accompanied by the Estonian translation, the Estonian branch is receiving a certificate of registration with a unique number of incorporation.

This certificate is necessary for applying for the VAT number. For this, a request must be submitted at the National Tax Board.

The last step in registering a branch in Estonia is registering with the Health Insurance Fund of Estonia. This process must take place no longer than seven working days after hiring an employee.

If all the documents and requirements are met, the establishment of a branch in Estonia in 2024 doesn’t take longer than 6 working days.

The management of a branch opened in Estonia must be performed by at least one Estonian resident or a citizen of Switzerland or an EEA country.

Activities which can be completed by a branch in Estonia

One of the particularities of opening a branch is that it can only complete the activities of the parent company. If the foreign company will have one activity, the branch office will be bound to undertake the same activity based on a license issued by the Estonian authorities in the respective field.

One of the industries in which branches operate the best is the financial sector. Most foreign banks and other financial institutions usually prefer to develop their activities in Estonia under the form of branches. Local companies can also set up one or more branches in other Estonian cities.

All the activities of a branch office in Estonia must undergo the same licensing procedures and steps as those of a local company.

If you need information about the licensing requirements in relation to the activities which can be completed by a branch in Estonia, our local representatives can assist you.

Licenses for branch offices in Estonia

Other fields that require licenses are: long distance telecommunication, mining, public utilities, pharmaceutical industry, reconstruction of infrastructure, gambling and the production of tobacco and alcohol. The license for this can be obtained from the specific authorities.

The branches established in Estonia don’t need to submit annual audited financial statements, but for the companies from countries not included in the EEA Agreements, is necessary to submit the approved audited financial statements at the Estonian Commercial Registry.

Taxation of branches in Estonia in 2024

One of the most important aspects when deciding to set up a business in Estonia refers to taxation. In the case of branch offices created by foreign companies, the taxation will occur on the activities completed on the Estonian territory. Before explaining how the taxation of a branch office occurs, it is important to know that the director appointed by the parent company must comply with the requisites of the Estonian Accounting Law and implement them in the accounting of the branch. This will imply the registration of the Estonian branch with the tax authorities and with the Health Insurance Fund (if the branch office has employees). The branch must also obtain an Estonian VAT number.

The corporate tax which needs to be paid by an Estonian branch office is set at a rate of 21%. The director of the branch will be required to file annual and tax reports with the Tax and Customs Board on the taxes paid by the branch. The parent company, if foreign-owned, will also be required to file its annual report with the Trade Register in Estonia.

We can also help with dedicated accounting services in Estonia, should you need us to. We can also help with obtaining EORI numbers in Estonia. Our accountants in Estonia can offer a variety of services that will increase the standard of your company. The primary accounting services offered by our team of specialists are related to bookkeeping, financial statement drafting and audits. However, we can also other accounting issues, such as tax and VAT registration for new companies on the market.

How long does it take to register a branch in Estonia?

The procedure of setting up branch office in Estonia in 2024 can take up to 1 month, mainly because of the formalities which need to be completed before the actual registration. These formalities refer to the drafting, translation and notarization of the documents which need to be filed with the Companies Register. From there, the registration procedure is completed within 5 days. The representatives of the parent company must also take into account the procedures of setting up the bank account and obtaining the necessary licenses to start the activities which take up to a few weeks.

The advantages of opening a branch office in Estonia

In 2024, the branch office is by far one of the simplest forms of starting a business in Estonia. Among its advantages, we can mention the fast company registration procedure, the simplified requirements in terms of share capital requirements and the fact that there are no restrictions when it comes to the industries it can operate in.

From a taxation point of view, we have mentioned above that the branch office will be taxed on the income generated in Estonia, however, branches can also take advantage of the double tax treaties signed by Estonia with numerous countries.

Our company formation consultants in Estonia can offer more information on the taxation of branches. We can also assist with specialized accounting services.

We invite you to watch our video on how to establish an Estonian branch:

Why set up a business in Estonia?

Foreign investors are invited to choose Estonia for setting up any type of businesses considering that:

- – according to the Bank of Estonia, the country is expected to register a 3.3% economic growth in 2019;

- – for 2021, the National Bank has also forecast an increase of 2%, while for 2022, the growth should reach 3.8%;

- – the unemployment rate should decrease to 4.6% by the end of 2019;

- – foreign workers have contributed with 1.3% to Estonia’s Gross Domestic Product growth in 2018.

At the level of 2024, many foreign companies are expected to expand their operations decide to set up branches in Estonia. These can be used for the completion of the same activities the parent businesses have in their countries of origin.

If you are considering opening a branch office in Estonia in 2024, our specialists are at your service with information on the latest updates.

Economic forecast for Estonia

Based on economic forecasts, the budget anticipates real economic growth of 2.7% in the year that started.

The budget for 2024 has investments and expenses totalling EUR 18.5 billion, while receipts are EUR 6.8 billion, resulting in a EUR 1.7 billion borrowing need.

Estonia is among the leading countries in Eastern and Central Europe regarding FDI per capita. The country has a very pro-business legislative framework and, more broadly, the Estonian society has a business-friendly attitude which is the expression of the country’s perfect integration into the northern circuit of production, in which Estonian branches and subsidiaries often function as outsourcing sites for Scandinavian parent companies. Estonia is highly developed in the FDI-attractive fields of IT, biotechnologies and green industries.

Our company formation specialists in Estonia are ready to provide you with the necessary consultancy and a personalized offer, perfectly adapted to your business need. Contact us to see how we can help you.