A subsidiary is a form of business opened by a foreign company in Estonia with a majority of share capital owned by it.

It is considered a legal entity and has a higher degree of autonomy than a branch. A subsidiary registered in Estonia must keep its own accounts and usually pay the corporate tax on profits in the country of origin.

With a vast experience in company formation matters in Estonia, our agents can help foreign companies seeking to open subsidiary companies here.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) | Estonia's Company Law |

|

Best used for |

All types of activities: – commercial; – trading; – retail, etc. |

|

Minimum share capital (YES/NO) |

EUR 2,500 when registered as a private limited liability company, EUR 25,000 when set up as a public enterprise |

| Time frame for the incorporation (approx.) | Approx. 5 working days |

| Documents to be filed by parent company |

– Articles of Association; – proof of legal address in Estonia; – share capital deposit reference from a local bank; – details of the parent company. |

| Management (Local/Foreign) |

Local management must be ensured, however, the director does not have to be an Estonian resident |

| Legal representative required (YES/NO) |

No, however, it is recommended to have a local officer |

| Local bank account (YES/NO) |

Yes, an Estonian bank account is mandatory when setting up a subsidiary in Estonia |

| Independence from the parent company |

The subsidiary is an independent type of company |

| Liability of the parent company | The parent company is not liable for the subsidiary's debts and obligations |

| Corporate tax rate |

20% |

| Annual accounts filing requirements |

Subsidiaries must file annual accounts within 6 months from the end of the financial year, but no later than June 30th |

| Possibility of hiring local staff (YES/NO) |

Yes, an Estonian subsidiary can hire local personnel |

| Travel requirements for incorporating branch/subsidiary (YES/NO) |

No, it is not necessary to travel to Estonia to incorporate a subsidiary company |

| Double tax treaty access (YES/NO) | Yes, Estonia has more than 60 double tax agreements. |

Types of companies that can act as subsidiaries

The forms that a subsidiary can take in Estonia are the public limited liability company and the private limited liability company.

The name of the subsidiary established in Estonia must be unique. For this purpose, the name has to be checked online in the Estonian Commercial Register and reserved if necessary.

An Estonian public limited liability company must provide a minimum share capital of 25,000 Euros, unlike a private limited liability company which’s capital must be formed by at least 2,500 Euros.

The management of a public limited liability company is assured by a board of managers and a board of supervisors. The private limited liability company is managed by a management board and only optional by a supervisory board.

The management board must be formed by at least one member, if there are more than one, a chairman must be elected. The supervisory board is formed by at least three members. Only the members of the management board may sign in the name of the subsidiary different documents and conclude contracts.

The liability of the company’s members is limited by their contribution to the capital.

The main characteristics of subsidiaries in Estonia

The establishment of a subsidiary in Estonia is governed by the Company Law which applies equally to local and foreign entrepreneurs. The representatives of foreign companies seeking to have a presence in Estonia and deciding for a subsidiary should know that:

- the subsidiary will be treated just like any other domestic company from a legal point of view;

- it has complete autonomy in relation to its parent company, therefore it has full decisional power;

- it requires a single shareholder (its parent company) and it can be registered as limited liability company in Estonia;

- the registration requirements are easy, while the timeframe for setting it up is reduced;

- the cost of opening a subsidiary, however, is higher than that of starting a branch office in Estonia;

- like any other local company, the subsidiary must have a legal address in Estonia.

Our Estonian company formation specialists can offer more information on the characteristics of subsidiary companies.

The subsidiary as a domestic company in Estonia

Often compared to the branch office, the subsidiary company has several advantages over the branch because it will be treated as any other local business. This is because it will complete its activities under one of the most popular business forms in Estonia, the limited liability company, but also because it will benefit from the simplified company registration procedure.

Apart from these, an Estonian subsidiary set up by a foreign company will be treated the same way as all domestic businesses. This means it will pay the income tax on its worldwide income in Estonia and will also benefit from this country’s double taxation agreements in terms of repatriation of profits.

It is possible for local companies to also operate through subsidiaries, however, because the activities of a subsidiary can differ from those of the parent company, which is why Estonian-based companies do not resort to the subsidiary as a means of doing business.

If you need information about the treatment of subsidiaries as local companies, our company registration agents in Estonia can provide you with it. We can also handle the preparations for registering a subsidiary in Estonia without the representative of the foreign companies to come here.

Companies are also required to go through the Estonia VAT registration process upon reaching a certain threshold.

Requirements for registering a subsidiary in Estonia in 2024

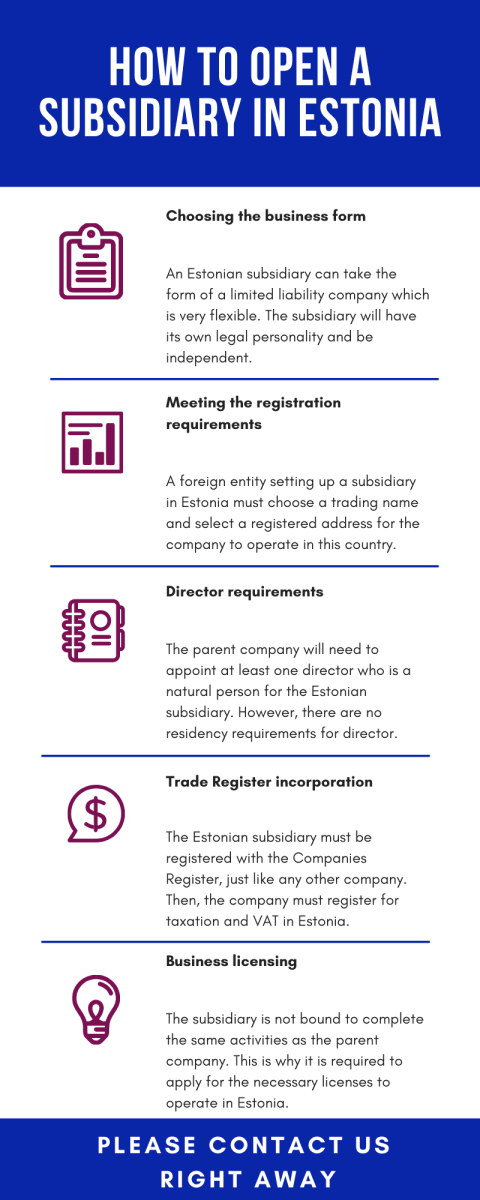

Foreign companies interested in establishing subsidiaries in Estonia in 2024 must comply with a set of requirements prior to starting the registration procedure. Among these, it is important for the foreign company to select a business name for the subsidiary. Unlike the case of a branch office, the subsidiary needs not bear the same name as the parent company, thus enhanced flexibility being provided.

The foreign company will need to find a registered address in an Estonian city (usually, the one it intends to operate in) for the subsidiary. Another requirement for the parent company is to prepare the documents required for company registration in Estonia.

It is also the parent company’s duty to select the business activities the subsidiary will undertake in Estonia. These can be the same as the foreign business’ or others.

If you need advice in the requirements related to setting up a subsidiary, our company formation agents in Estonia can offer the necessary assistance.

We also invite you to read about the opening of an Estonian subsidiary in the scheme below:

Other registration requirements for subsidiary companies in Estonia

Setting up a subsidiary in Estonia implies respecting the provisions of the Company Law and for this purpose the parent company will act as a shareholder in the company. In the case of a private limited liability company, the subsidiary will only need a director, however, the director must be a natural person. No residency requirements apply for the director of an Estonian subsidiary.

The creation of an Estonian subsidiary implies having a registered address in this country, considering it will be treated like a local company. For this purpose, we can help you with virtual office services which can be used in the first Estonian company formation stage. A permanent office can be found after and the change in the registered address must be reported with the Companies Register.

One of the mandatory requirements for opening a subsidiary in Estonia is for it to have a bank account opened with a local bank. This is because all the transactions of the subsidiary must pass through an Estonian bank account.

If you want to open a company in Estonia and need advice on the structure to use, our local consultants can guide you.

Documents required for opening a subsidiary in Estonia

The documents to be filed when opening a subsidiary in Estonia are:

- – the parent company’s Articles of Association and Certificate of Registration;

- – the subsidiary’s Articles of Association;

- – proof of the subsidiary’s registered address;

- – proof of depositing the share capital of the subsidiary in accordance with the selected business form;

- – details of the manager (s) appointed in the subsidiary company;

- – other documents, as requested by the Trade Register in Estonia.

In case the foreign company wants to transfer employees to its subsidiary in Estonia, it needs to apply for employment visas on their behalf.

Our local consultants can handle the procedure of preparing the documents needed for setting up a subsidiary in Estonia.

Subsidiary registration in Estonia in 2024

Before starting any activities, certain types of companies must register in the Register of Economic Agency, for example companies which performs activities in the following area: building, tourism, employment, travel, accommodation services, mining, pest control, industry or liquid fuel.

All the legal entities must register in the Commercial Register after opening a bank account and depositing the minimum share capital so the subsidiaries are no exception. The main difference is that the decision of opening a subsidiary in Estonia must be attached to the specific documentation (articles of association, list of shareholder and their contribution, details regarding the non cash contribution) and request for registration.

Another requirement for registering a subsidiary in Estonia is to register for VAT and for Central Sick Fund of Estonia. The last step is only for the subsidiaries which will hire personnel.

Activities completed by subsidiaries in Estonia

The activities of a subsidiary set up by a foreign company in Estonia in 2024 can be the same as those of the parent company, however, it can also undertake additional activities and thus adjust to the market conditions in this country. From this point of view, the subsidiary is more flexible than the branch office which is bound to complete the same undertakings as its parent company.

The subsidiary can be used for completing trading activities, for operating in the retail sector where it can sell various goods, or it can be used by holding companies seeking to own shares in an Estonian company.

Estonia is a good country for starting an IT company, which is why a subsidiary company can be used for various activities such as fintech and cryptocurrency-related activities. This is because in Estonia cryptocurrencies are recognized and companies can operate under virtual currency services licenses.

Our agents can help foreign investors who want to set up cryptocurrency companies in Estonia.

Licensing requirements for subsidiaries in Estonia

In order to complete business activities in Estonia, a company will need to apply for specific licenses with various authorities, agencies or ministries depending on the industry it will operate. The same requirements apply to Estonian subsidiaries which are required to apply for such licenses through their representative. The licensing procedure will be completed the same way as for any other company in Estonia.

Holding and subsidiary companies in Estonia

One of the main uses of an Estonian company is that of serving as a subsidiary for a holding company. The latter can be registered in Estonia or abroad and has the main purpose of owning shares or other assets in the Estonian subsidiary. The holding company will also control the management of the subsidiary.

An important aspect of holding companies in Estonia is that they can be subject to the Parent-Subsidiary EU Directive which allows for a favorable taxation system applied to both the holding and its subsidiary/subsidiaries. We can also assist with EORI registration services in Estonia.

Our Estonian agents can also help foreign investors interested in setting up holding companies here.

Taxation of subsidiaries in Estonia

Estonian subsidiary companies will be treated just like local companies from a taxation point of view. This means they will need to register for taxation purposes with the Estonian tax authorities and pay the corporate tax on their worldwide income. The Estonian corporate tax is currently levied at a rate of 20%.

The subsidiary is also subject to the same accounting and filing requirements like domestic companies. However, they are entitled to obtain tax deductions and exemptions in accordance with Estonia’s double taxation agreements, provided that the parent company’s home country has signed such a convention with Estonia.

We can also advise on matters related to employment. No matter how many employees you have or what industry you work in, our team will find solutions that work for you as our accounting services in Estonia are tailored to the size and specifics of the firm. You can contact our specialists for solutions that best fit your company’s needs. We offer assistance in a wide range of financial matters.

We invite you to watch a video on the characteristics of a subsidiary in Estonia:

Why open a subsidiary in Estonia?

The various legal forms which can be used to conduct a business activity in Estonia can put foreign companies in difficulty when it comes to selecting the appropriate type of structure. The subsidiary offers several advantages, among which an easy and fast incorporation procedure which can be completed in a matter of days. Apart from these, the subsidiary is fully autonomous, which means it can register higher profits than its parent company, profits remitted to the foreign business.

Estonia is also an appealing destination for setting up a subsidiary or any other type of business, considering that:

- – in 2018, the net inflow of foreign direct investments (FDIs) was 1,3 million USD;

- – according to the 2019 UNCTAD World Investment Report, the FDI stock represents 80.3% of Estonia’s Gross Domestic Product;

- – according to OECD, most of the foreign investments are injected in the financial and insurance sector (28.6%);

- – among the most important countries to invest in Estonia are Sweden (27.7%) and Finland (22.3%) out of all FDI stock.

Optimistic forecast for the Estonian economy

The estimated economic growth for Estonia for 2024 is 3.2%, according to the IMF. While investment is anticipated to gradually return despite tighter financial circumstances, private spending is anticipated to be little. The growth in the economies of the country’s trading partners is likely to keep exports modest.

However, Estonia’s economy is predicted to grow by 10.2% over the 5 five years, translating into an average GDP growth rate of 2%. For those looking to invest in Estonia, the predicted sustainable growth rate is encouraging. A faster rate of nearly 3% growth might be expected in 2025 and 2026.

Fintech is one of the sectors that is expected to have great results in 2024 and setting up an Estonian subsidiary through which services in this industry are offered can be a great solution for foriegn enterprises.

If you have any questions on on the requirements for 2024 related to opening a subsidiary in Estonia, you can direct them to our local advisors.

Please contact us if you are interested in opening a subsidiary in Estonia.

The whole process of registration for the Estonian subsidiary takes about one week if all the documents are entirely deposited. For consultance regarding the laws in this country our attorneys partners from Estonia will be at your service.